Learn Budget Skills That Actually Stick

Join our live sessions where we break down money management without the jargon. Real conversations with people who've been helping Australians sort their finances for years. No sales pitch—just practical advice you can use straight away.

Reserve Your Spot

Upcoming Sessions This Year

We run these throughout 2025. Sessions are interactive—bring your questions and we'll work through them together.

Emergency Funds: Building Your Safety Net

Three months of expenses sounds impossible? We'll show you how to start with what you've got right now. Most people are surprised by how quickly small amounts add up.

Register NowDebt Reduction: Where to Start

Credit cards, personal loans, car payments—when you're juggling multiple debts, it's hard to know which one to tackle first. We'll map out a plan that actually works with your income.

Register NowTracking Spending Without Losing Your Mind

Nobody wants to log every coffee purchase. We'll show you a simpler approach that gives you the insights you need without turning budgeting into a second job.

Register NowHoliday Spending: Plan Now, Relax Later

January credit card bills are painful. Let's work backwards from your budget and figure out what you can actually afford this December—before you spend it.

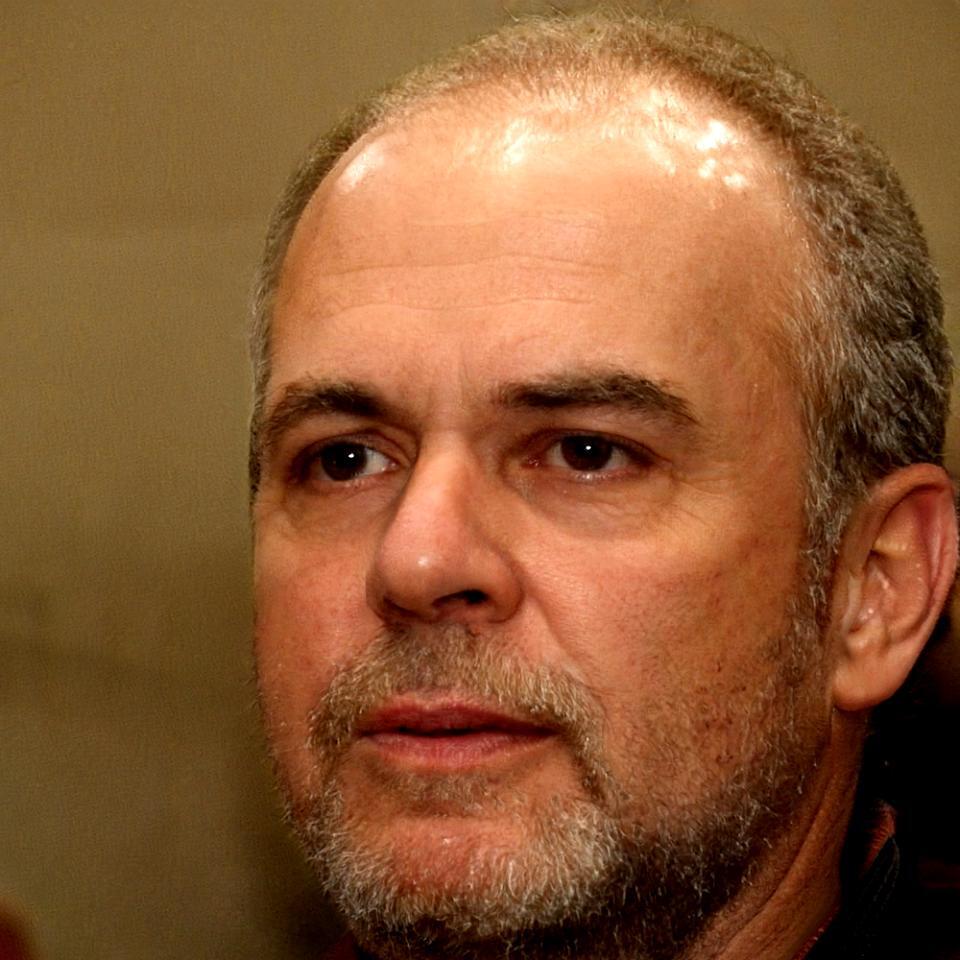

Register NowWho's Running These Sessions

Both have spent years working with everyday Australians on budget challenges. They're good at explaining things clearly and won't make you feel bad about past money decisions.

Lennart Sørensen

Worked with over 400 families across Sydney and Melbourne helping them build sustainable budgets. Started his career in banking before shifting to education because he wanted to help people avoid the mistakes he saw every day.

Eleri Vaughan

Specializes in helping people climb out of debt without sacrificing their quality of life. She's straightforward about what works and what doesn't—no sugar coating, but plenty of practical strategies you can start using immediately.

Setting Up Your First Budget

Start with income and fixed expenses, then work out what's left for everything else.

The Envelope System for Digital Banking

How to use the old cash envelope method when everything's electronic now.

Handling Irregular Income

Budgeting when your paycheck changes every month is tricky but doable.

Preparing for Big Expenses

Car registration, insurance renewals, school fees—they're not surprises if you plan ahead.